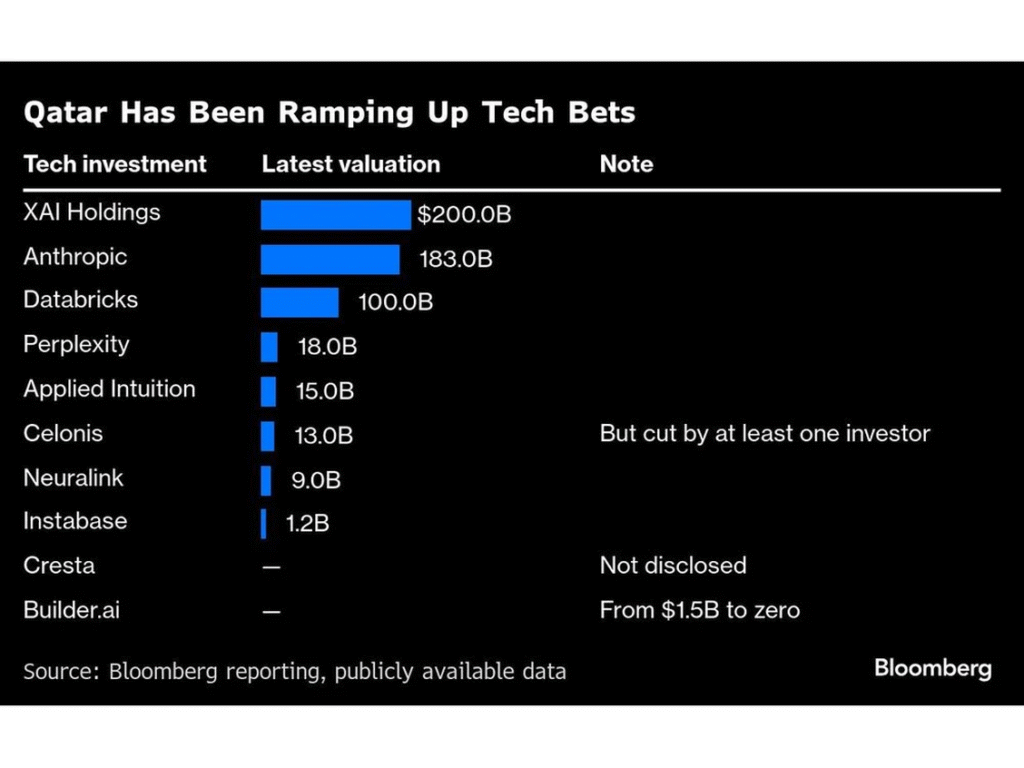

The $524 billion Qatar Investment Authority is stepping up its investments in the US with high-profile commitments to artificial intelligence and digital infrastructure, underscoring how Doha is keeping its economic priorities separate from geopolitical tensions in the Middle East.

The Qatar Investment Authority (QIA) and Blue Owl Capital Inc. have announced a partnership agreement.

This collab establishes a digital infrastructure platform aimed at addressing the explosive demand for compute power driven by cloud computing and artificial intelligence advancements.

With initial assets exceeding $3 billion, the partnership underscores the convergence of sovereign wealth and private capital in fueling the backbone of tomorrow’s digital economy.

The agreement marks a significant expansion for both entities.

QIA, Qatar’s sovereign wealth fund established in 2005, manages over $500 billion in assets and has long been a global player focused on infrastructure and technology investments.

Blue Owl, a New York Stock Exchange-listed alternative asset manager, brings its Real Assets platform to the table, which has reportedly amassed $39 billion in capital commitments.

This platform spans 104 facilities across 28 markets worldwide, positioning Blue Owl as a key player in mission-critical digital assets.

At its core, the partnership targets the digital infrastructure sector—specifically data centers and connectivity solutions that power hyperscalers like Amazon Web Services, Microsoft Azure, and Google Cloud.

As AI models grow more sophisticated and data generation increases, the need for scalable, resilient infrastructure has never been more acute.

“The surge in cloud and AI transformation is creating unprecedented demand for global compute availability,” the joint announcement stated.

By pooling resources, QIA and Blue Owl intend to deploy capital toward large-scale portfolios that enhance data storage, computation, and interconnectivity, ensuring these assets can withstand the rigors of 24/7 operations.

Financially, QIA’s infusion is the catalyst, launching the platform with a portfolio of data center assets valued at more than $3 billion.

This initial commitment is not a one-off; the structure emphasizes long-term growth through Blue Owl’s permanent capital vehicle, which allows for sustained investment without the pressures of traditional fund timelines.

This approach aligns with broader industry trends, where investors seek stable returns from infrastructure amid volatile equity markets.

For context, global data center investments are projected to exceed $400 billion annually by 2027, according to recent McKinsey reports, driven by AI’s appetite for processing power.

QIA contributes its global footprint and expertise in high-stakes infrastructure deals, from European renewables to Asian tech hubs.

Blue Owl, meanwhile, leverages its operational acumen in real assets, having navigated complex financings for hyperscale operators.

Together, they aim to de-risk investments in energy-intensive data centers, incorporating sustainable practices like renewable energy integration to mitigate environmental concerns.

This partnership also signals Qatar’s deepening role in the West’s tech ecosystem, diversifying beyond oil and gas into the intangible fuels of the digital age.

Executives from both sides expressed unbridled optimism. Mohammed Saif Al-Sowaidi, CEO of QIA, highlighted the alignment with Qatar’s forward-looking mandate:

We are pleased to partner with Blue Owl in this transformational digital infrastructure platform.’

This partnership aligns with QIA’s strategy to engage with global firms that are addressing the world’s demand for data centers.

QIA and Blue Owl are committed to scaling digital infrastructure that will meet the demand for data storage and computation requirements globally, with a particular focus on increasing data connectivity.”

Blue Owl Co-CEOs Doug Ostrover and Marc Lipschultz emphasized:

“QIA’s commitment to innovation aligns seamlessly with our strategy to provide financing solutions to large-scale, resilient, digital infrastructure portfolios. Together, we aim to meet the surging demand for data connectivity and power the next generation of digital transformation.”

Looking ahead, the platform’s growth trajectory could redefine investment norms in digital infrastructure.

As AI adoption accelerates—think generative models training on petabytes of data—these assets aim for steady cash flows from long-term leases to tech companies.

Yet challenges persist: regulatory hurdles in key markets, geopolitical tensions, and the push for carbon-neutral operations.

If navigated adeptly, this venture could yield not just financial returns but also geopolitical leverage, positioning Qatar as a pivotal node in the AI supply chain.

In an era where data is the new oil, the QIA-Blue Owl alliance arrives at a pivotal moment.

By bridging sovereign stability with private agility, it exemplifies how collaborative capital can propel advancements forward.

As hyperscalers race to build out exascale computing, partnerships like this could in ensuring the digital economy doesn’t stall for lack of proper infrastructure.

Access the official press release here; QIA announcement here.

Source link here.